Centrelink 101: A Guide to Age Pension and Commonwealth Seniors Health Card

Introduction

As you approach retirement age, forward planning every source of monetary support becomes increasingly critical. One of the key components of this planning is understanding the Age Pension and the Commonwealth Senior Health Card, both administered by Centrelink.

Age Pension: A Vital Lifeline

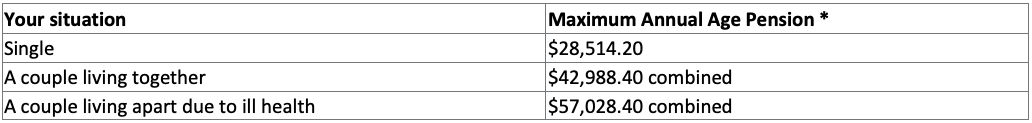

The Age Pension is a vital safety net designed to provide financial assistance to Australians aged 67 and over who meet specific eligibility criteria. It is intended to ensure that retirees can maintain a reasonable standard of living throughout their retirement years. The age pension can provide financial support up to the following amounts:

* as at September 2023

To be eligible for the Age Pension, you must meet the following criteria:

- Age Requirement: You must be at least 67 years old, but this age may increase in the future as the government adjusts the pension age.

- Residency: You must be an Australian resident and meet certain residency requirements. These requirements typically involve residing in Australia for a specified number of years.

- Income and Asset Tests: Centrelink assesses your income and assets to determine your eligibility for the Age Pension. For the purposes of the Income Test, Centrelink will assess income from all sources including employment and investment earnings. Assets encompass most assets you and your partner own with the notable exception of your principal residence.

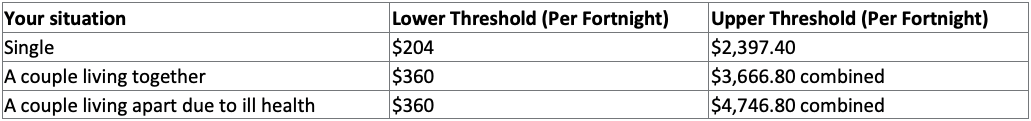

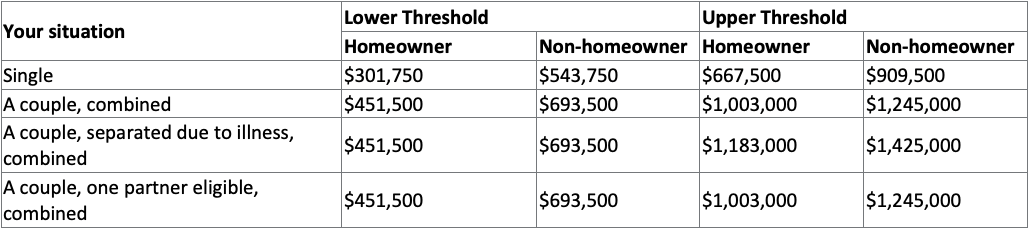

Based on your family situation the lower thresholds represent the maximum allowable income and assets to be eligible for the full age pension. The upper thresholds represent the maximum allowable income or assets to be eligible for a part Age Pension. Centrelink will assess your situation using the test which results in the lower age pension payable.

Income Test:

Assets Test:

The Age Pension provides a financial lifeline for many retirees, but it’s essential to understand the means testing process and how it may affect your pension amount. Professional financial advice can help you optimise your financial situation to maximise your Age Pension entitlement while complying with Centrelink’s rules.

Commonwealth Senior Health Card: Access to Health Benefits

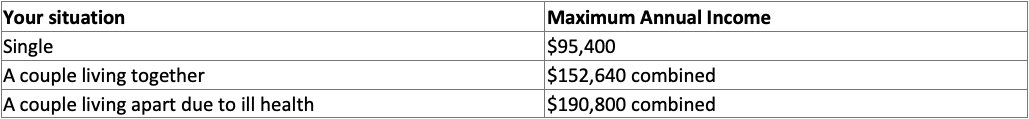

The Commonwealth Senior Health Card is another valuable benefit for eligible retirees. It provides access to essential health-related concessions and benefits, helping you manage the costs associated with healthcare and prescriptions. To qualify for the Commonwealth Senior Health Card, you must be aged 67 or over, be an Australian resident and satisfy the income test.

The income test is the primary eligibility requirement for the Commonwealth Senior Health Card. If you meet the income threshold, you will be eligible to receive the card. Below are the current income thresholds:

Holding a Commonwealth Senior Health Card offers several valuable benefits, including:

- Pharmaceutical Benefits Scheme (PBS) Discounts: Cardholders are entitled to significant discounts on prescription medicines under the PBS. This can lead to substantial savings on essential medications.

- Medical Services: You may be eligible for bulk-billed doctor’s visits under Medicare, meaning you won’t have to pay any out-of-pocket expenses for essential medical consultations.

- Concessional Rates: The card provides access to concessions on various health services, including eye care, dental services, and hearing aids.

- Energy Rebates: Depending on your state or territory, you may also qualify for energy rebates, which can help reduce your utility bills.

- Travel Discounts: Some states offer travel concessions, such as reduced public transportation costs and discounted taxi fares.

Navigating Centrelink: The Application Process

Applying for the Age Pension and Commonwealth Senior Health Card can be a complex and time-consuming process. To simplify this, follow these steps:

- Gather Required Documents: Ensure you have all the necessary documents, including proof of identity, residency, income, and assets.

- Contact Centrelink: Reach out to Centrelink to begin your application process. You can do this online, over the phone, or in person at a Centrelink office.

- Attend an Interview: Centrelink may require an interview to assess your eligibility accurately. This can be conducted in person or over the phone.

- Submit Your Application: Complete the required forms and provide all supporting documents promptly to expedite the application process.

- Await Assessment: Centrelink will assess your application and provide a decision regarding your eligibility and entitlements.

A Vantage adviser can assist you through the application process and streamline what can be a burdensome process.

As you approach retirement, financial planning becomes more critical than ever. Professional financial advice from Vantage can help you navigate the Centrelink system, optimise your pension entitlements, and ensure you receive the healthcare concessions you deserve through the Commonwealth Senior Health Card. By staying informed and seeking expert guidance, you can enjoy a more financially secure and comfortable retirement.

Disclaimer:

All information relating to the eligibility criteria a valid as at 20 September 2023 and are subject to change.

About the Author: