The Gradual but Harmful Impact of Inflation on Your Wealth

The sudden surge of inflation, largely influenced by the COVID-19 pandemic, has prompted a renewed interest in how it affects investors. The truth is, inflation has always eroded the purchasing power of money, making it crucial for investors to consider and understand.

Past Impact of Inflation

The impact of inflation can be seen as a destroyer of the purchasing power of money. Put simply, inflation reduces the future worth of your wealth.

If you had $100,000 in cash in 2000 and locked it in a safe then opened the safe today, you would still have the same $100,000 but it would only buy the equivalent of $54,000 worth of today’s goods and services. Over these years, that $100,000 in cash would have lost 46% of its purchasing power. [Source: Ashley Owen: “The wealth-destroying impact of inflation” (2022)].

Future Impact of Inflation

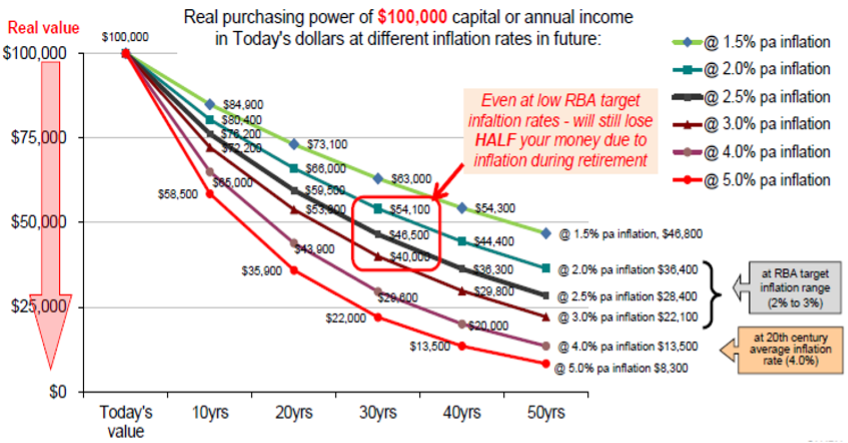

As the inflation rate increases, your ability to purchase goods and services with the same amount of money decreases over time. The chart below illustrates how the purchasing power of money is affected at varying levels of inflation over different time frames:

There are two key lessons that can be derived from the chart above:

- Even if inflation is contained withing the Reserve Bank of Australia’s (“RBA”) target range of 2-3% per annum (compared to the headline inflation rate of 7.8% in Australia as at 31 December 2022), your wealth will still lose roughly half of its purchasing power after 30 years; and

- The second lesson is that the impact of inflation on your wealth increases with the length of time you need the money to last, whether it is for your own lifespan or for the benefit of your beneficiaries. As a result, it is crucial to invest in growth assets that provide some protection against inflation.

Historical Performance Analysis

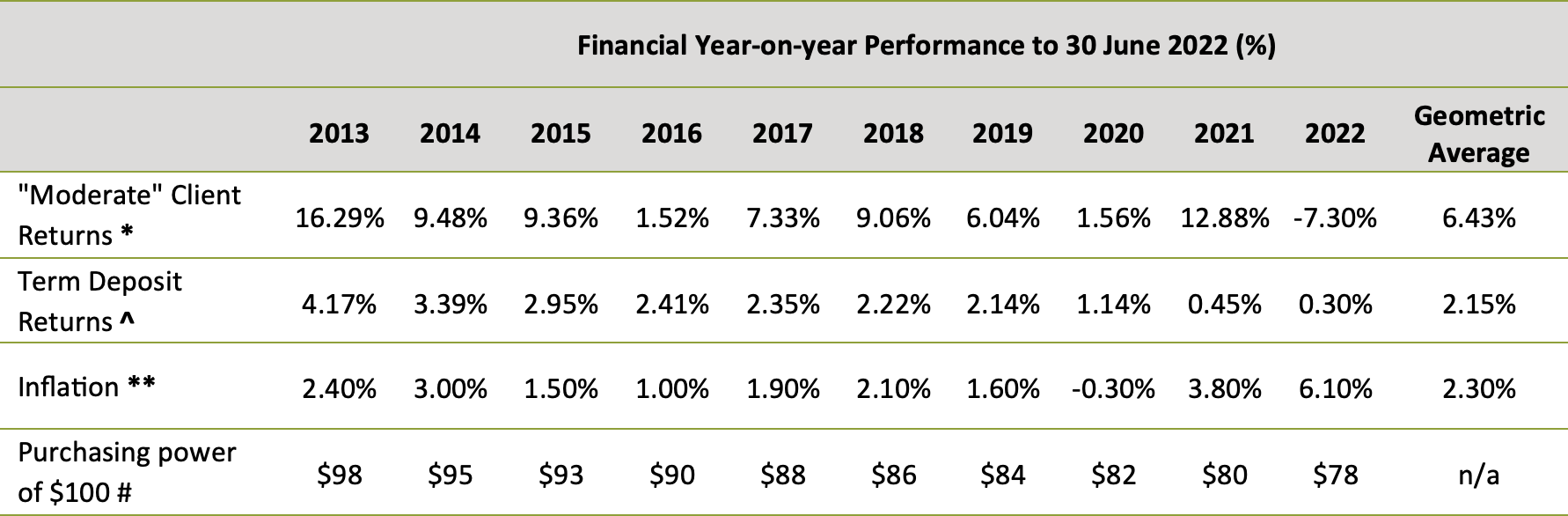

As part of our analysis, we have compared the historical financial year-on-year performance of the following to 30 June 2022:

- “Moderate” Risk Profile Vantage Client Returns;

- Term Deposit Returns;

- Australian Inflation; and

- Purchasing power of $100.

* These returns are calculated after all fees (administration, investment and advice fees) and before taxes. These are based off a sample group of 19 Vantage “Moderate” risk profile clients of which we have been providing advice to for at least 10 years. [Source: Vantage]

^ Retail term deposit 1-year rates. Average is determined by a simple average of the five largest banks rates on offer. [Source: RBA]

** Year-ended inflation (CPI) change. [Source: ABS/RBA]

# Based on an inflation rate of 2.50% p.a.

Performance Comparison

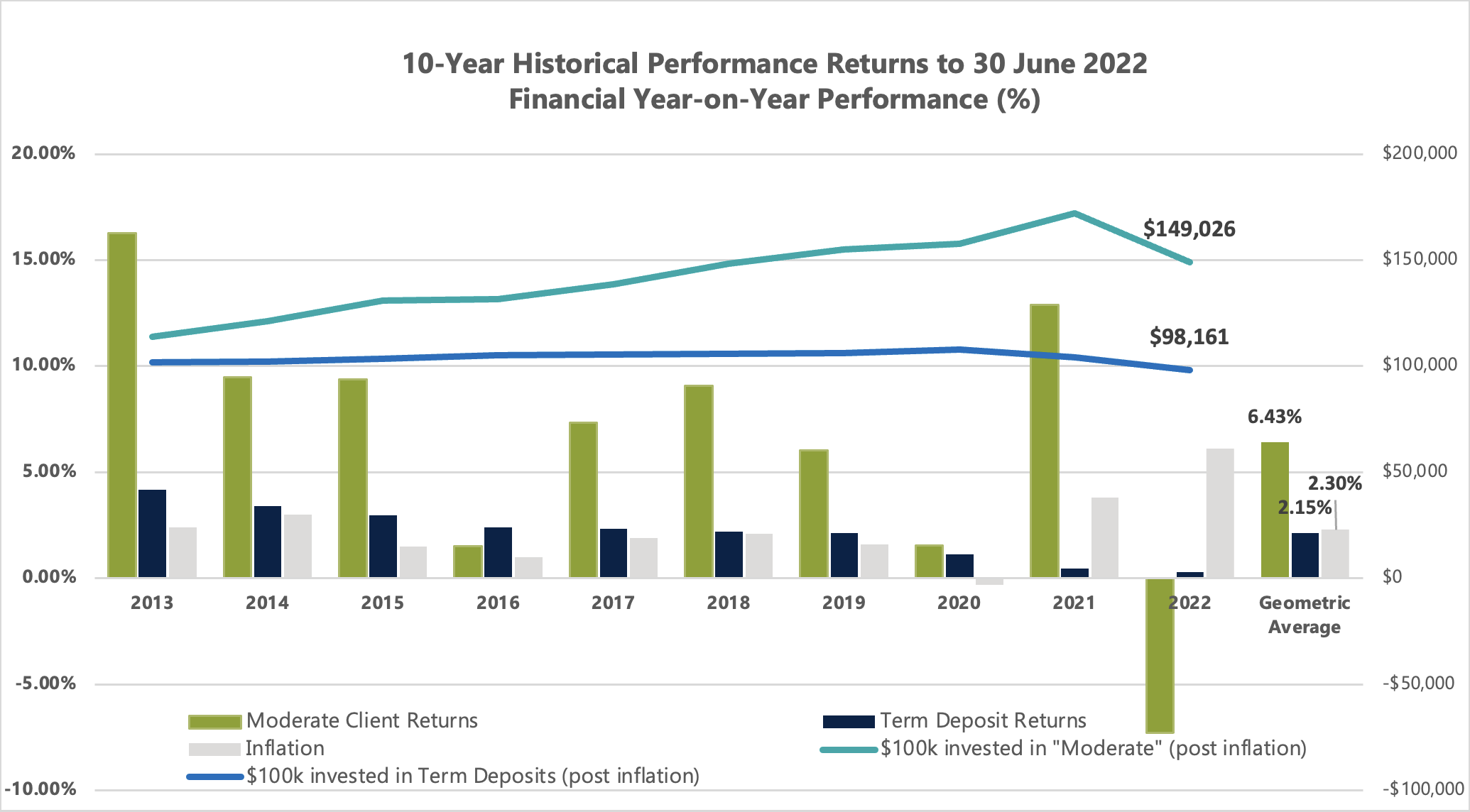

In the chart below, we have illustrated two aspects from our historical performance analysis above:

- Line graph on chart: If $100,000 was invested in a Vantage “Moderate” risk profile over the last 10 years (post inflation) compared to if the same $100,000 was invested in term deposits, using the data outlined in Table 1

- Bar graph on chart: The returns of Vantage “Moderate” clients, term deposit returns and inflation, using the data outlined in Table 1

Please note that historical returns are not an accurate indicator of future performance. These are provided for illustrative purposes only.

To summarise, when it comes to investing for the long-term, there are two main types of assets: growth assets and defensive assets. Growth assets involve investing in businesses, infrastructure and real estate, which can offer protection against inflation but can be risky during economic downturns. Defensive assets, on the other hand, such as bonds, term deposits, and cash offer regular income and stability, but do not protect against inflation. Retirees often prefer defensive assets because of their reliability, but all investors should consider a mix of both types of assets in their portfolios to achieve growth over time and protect against the potential wealth-destroying effects of inflation.

About the Author:

Luke Pirozzi – Associate Adviser – Vantage Wealth Management

Follow us on social Media: